As part of its move towards being a mobile-first application, however, Venmo has expanded its reach to include many of the same locations that accept PayPal. The payment option available to millions of businesses in more than 200 countries around the world. PayPal and Venmo are both services of PayPal, Inc.

What You Can Do At Venmo.com

If you have a Venmo account, you can still use the Venmo website to check your balances, settings, and statements. The site also allows y0u to transfer money or cash out. From Venmo.com, you can even invite your friends to join the service through Facebook. Don’t have a Venmo account? You can sign up for free from the website. You can create an account using your Facebook login or email. From there, you can begin receiving money or making requests across the supported platforms.

What About Web-Based PayPal Payments?

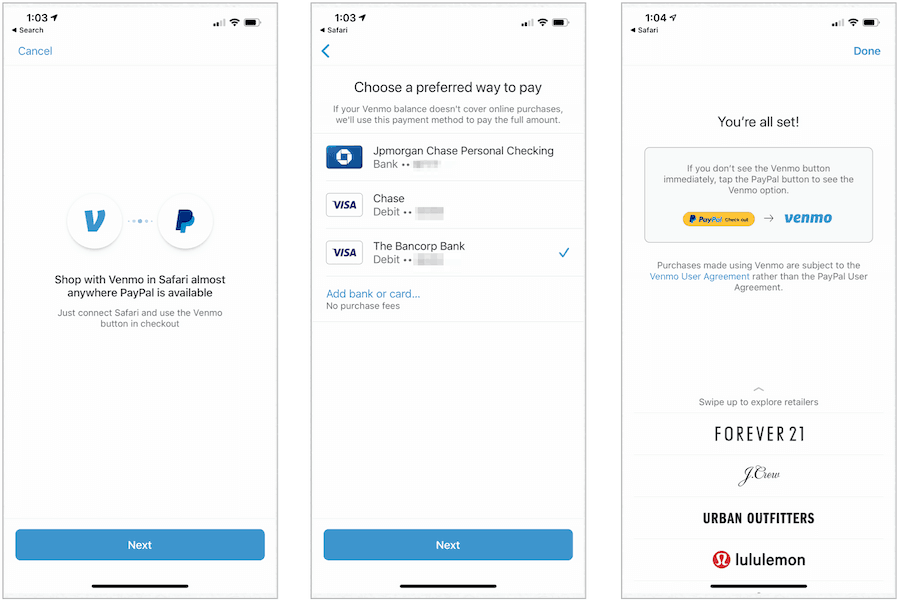

There are two ways to know when a mobile web-based company accepts Venmo as a payment method. First, you’ll see a Venmo-branded payment button at checkout. In some cases, instead, you might see some Venmo language after you first select PayPal as your payment method. You need to opt-in on the Venmo app on the App Store or Google Play to use this feature. After you do, tap the PayPal button on a mobile web browser to launch checkout. On accepted sites, you then see the Venmo payment option appear on the next page. Otherwise, you’ll see a Venmo button on a merchant app or mobile website during checkout.

How to Use Venmo

Receiving Money

Sending Money

To send someone money through Venmo, you’ll need to know their email or phone number. By default, Venmo will pull the money out of your Venmo account. If there isn’t money in that account or you’re short, it will go down the list of accounts or cards you’ve attached to your Venmo account. When you send money from a linked bank account, debit card, or your Venmo balance, the service is free. When you use a credit card, the company charges 3 percent.

Venmo Card

In 2018, Venmo began offering a physical MasterCard debit card to users. The card provides ATM access and overdraft protection and is usable anywhere that accepts MasterCard in the United States. Venmo enables up to $400 in daily ATM withdrawals and charges $2.50 per transaction at non-Money-Pass ATMs. Otherwise, the debit card is free. When enabled, the Venmo Card includes a reload function, which brings money from your linked checking account to the card in $10 increments. The feature kicks in whenever a purchase is made and there isn’t enough money available. Card purchases are noted on your Venmo transaction history, and the card is easy to disable from inside the app if you misplace it.

Payment Limits

Venmo’s current payment limits are as follows:

Sending limit, $2,999.99 weeklyAuthorized Merchant Payments, $2,000 per purchase, 30 transactions per dayVenmo Mastercard, $3,000 per purchase; ATM, $400 withdrawal daily limitWeekly limit, a total of $4,999.99.

Venmo was first introduced in 2009 as a way for persons to split bills for movies, dinner, rent, tickets, and other events. Since then, it has grown significantly. In the fourth quarter of 2019, the company’s net payment volume amounted to $29 billion, representing a 56 percent year-on-year growth. You can learn more about the Venmo service through the website or through the app, which is available for iOS and Android-based devices. Comment Name * Email *

Δ Save my name and email and send me emails as new comments are made to this post.

![]()